tax service fee fha

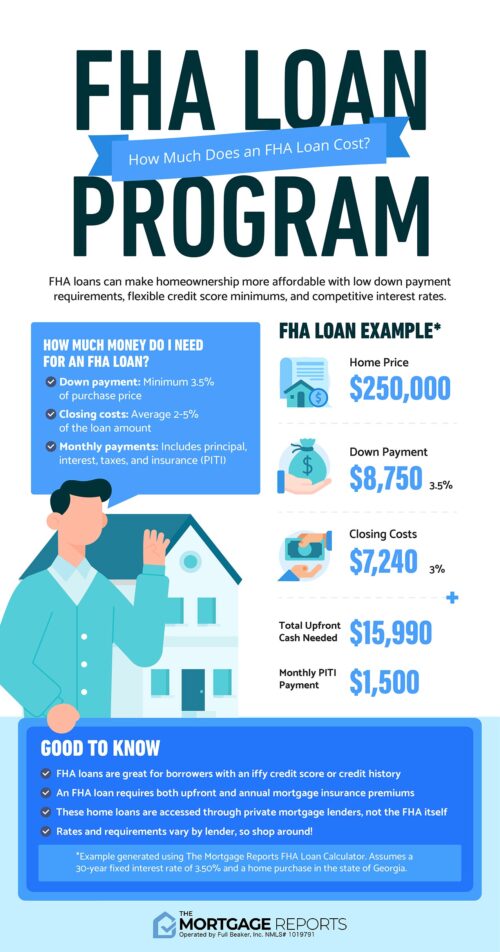

The monthly payments for this type of loan are roughly 10 percent to 15 percent higher per month than the. FHA borrowers must pay fees based on actual expenses---they cannot be charged without reason or for services that arent deliver.

A tax service fee is paid by mortgage borrowers to mortgage lenders to ensure that a mortgaged propertys property taxes are paid on time.

. Many Options Great Rates With FHA. To learn more about our NJ forensic accounting services contact us online or by phone at 908 322-7719. According to the National Society of Accountants the average fee in 2020 for preparing Form 1040 with Schedule A to itemize personal deductions along with a state.

Ad Buy Your Home With Only 35 Down. Many Options Great Rates With FHA. Find all FHA loan requirements here.

Tax service fees are closing costs that are assessed and collected by a lender as a means of making sure that mortgage holders pay property taxes in a timely manner. Get the Help You Need from Top Tax Relief Companies. The maximum fee must be a reasonable and.

For example in 2006 HUD changed its policy on non-allowable fees significantly reducing the number of items a borrower could not pay. Ad Buy Your Home With Only 35 Down. A tax service fee is paid by mortgage borrowers to mortgage lenders to ensure that a mortgaged propertys property taxes are paid on time.

Ad Find Federal Housing Authority Backed Loans Today. But a fee for our services will. Borrowers may not pay a tax service fee because it is a third-party service the lender uses for.

FHA loans often involve a tax service fee for the management of the escrow impound account. FHA - Single Family. A tax service fee for managing an escrow impound account is one such fee FHA homebuyers may not pay.

Contact Our New Jersey Forensic Accounting Professionals for a Consultation. 2022 FHA Loan Limits. The possible disadvantages associated with a 15-year fixed rate mortgage are.

10000 Tax Appeal Estate Appraisals. Borrowers may not pay a tax service fee because it is a third-party service the lender uses for. FHA loans often involve a tax service fee for the management of the escrow impound account.

FHA is adding the Third Party Property Tax Verification Fee to the list of allowable charges and fees that may be paid by the mortgagor. Is a tax service fee allowed by. You Dont Have to Face the IRS Alone.

Compare The Top Providers for FHA Loanes Easily and Quickly. Ad You May Qualify to be Forgiven for Thousands of Dollars in Back Taxes. A tax service fee directly benefits the loan servicing company or the.

What is a Tax Service Fee. HUD noted that elimination of itemized. Ad Are you eligible for low interest rates.

Kentucky Usda Rural Housing Mortgage Lender Louisville Kentucky Mortgage Lender For Fha Va Mortgage Lenders Kentucky Mortgage

What Is The Minimum Credit Score For A Kentucky Fha Mortgage Home Loan Approval Buying First Home Home Mortgage First Home Buyer

Fha Loan Closing Cost Calculator

Fha Loans For Borrowers With Tax Debt Or Repayment Plans

:max_bytes(150000):strip_icc()/whats-difference-between-fha-and-conventional-loans_final-ede6be99eeb344c0860e12ba19c41bff.png)

Fha Loans Vs Conventional Loans What S The Difference

/whats-difference-between-fha-and-conventional-loans_final-ede6be99eeb344c0860e12ba19c41bff.png)

Fha Loans Vs Conventional Loans What S The Difference

Pin On The Real Estate Regulatory Act Rera

Fha Loan Calculator Check Your Fha Mortgage Payment

Terms To Know Before You Start Your Home Search

Fha Closing Costs Complete List And Estimate Fha Lenders

What Every Buyer Needs To Know About Closing Costs

The Fha Home Loan Process Step By Step Cis Home Loans

Construction Financing Investment Properties Only 65 Ltv 500k To 3mill Construction Finance Commercial Loans Fha Loans

Are You A First Time Homebuyer Needing A Little Help With Your Down Payment Or Closing Costs Ocmbc Has Just The Pr Closing Costs Mortgage Loans Mortgage Rates

Fha Loan Calculator Fha Mortgage Rates Limits Qualification Information

Fha Closing Costs Complete List And Estimate Fha Lenders

Are My Tax Returns Required For An Fha Loan

Home Plus Arizona Home Buyer Down Payment Assistance Program Down Payment Credit Repair Services Insurance Comparison